House payments also decreased in February 2024. In new contracts, interest rates decreased for the 4th time.

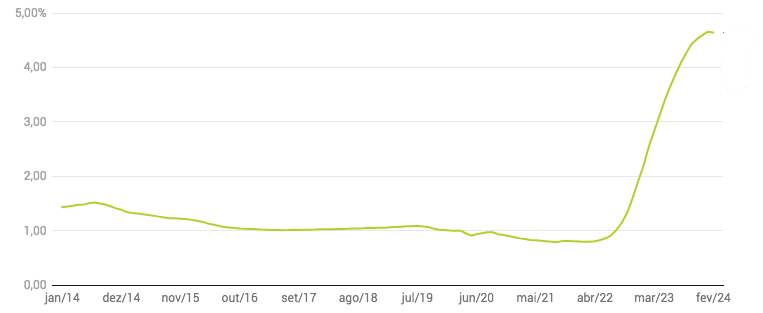

Interest on new housing loans has been falling for four consecutive months, having stood at 4.197% in February. Now, it is observed that the recent (slight) drops in Euribor and the more accessible mixed rates are also having an effect on the interest rates implicit in the total number of housing loans in the country. This is because, according to the National Statistics Institute (INE), this interest rate decreased for the first time since March 2022, to 4.641% in February 2024. This drop in interest rates was also reflected in house payments.

“The implicit interest rate on housing credit fell to 4.641% in February, 1.6 basis points (bps) lower than that recorded in the previous month (4.657%), being the first decrease recorded since March 2022”, says INE in the statistical bulletin released this Monday, March 18th.

Also for financing the purchase of housing – “the most relevant in all housing loans” – the implicit interest rate for all contracts fell for the first time since March 2022, to 4.606% (-1.7 p.b. compared to January).

Implicit interest rate on housing loans (%):

This drop in interest rates on total home loans had a slight impact on home payments. “The average installment registered the first reduction since February 2021, standing at 403 euros, 1 euro less than in January, which translates into a monthly decrease of 0.2% (+1% in the previous month )”, the publication also reads.

Thus, the payment for the house registered in February this year (403 euros, on average) is broken down:

Interest: corresponds to 248 euros (62% of the total)

Amortized capital: 155 euros (38%).

This slight decrease in interest and house payments on total housing loans in force in Portugal can be explained by the recent reductions in Euribor rates, but also by the greater number of loans taken out at mixed rates with lower interest rates, at least at the beginning of the contract. . But even so, the payment for the house continues to be 25.2% higher than that recorded a year ago (81 euros more), at a time when interest represented just 41% of the average value of the payment (322 euros).

It should also be noted that, in February 2024, the average outstanding capital for all contracts rose by 368 euros compared to the previous month, standing at 65,158 euros.

Evolution of the average value of the house payment

Average payment (euros/month)

(Total housing credit contracts)