Families are buying more expensive houses and asking banks for more money, reveals a report by idealista/créditohabitação. The demand for housing credit in Portugal has been shaped by the context of high interest rates and low purchasing power experienced in the last year. Families have been buying houses at lower prices and asking for smaller loan amounts. But at the start of 2024 this trend was...

Financial

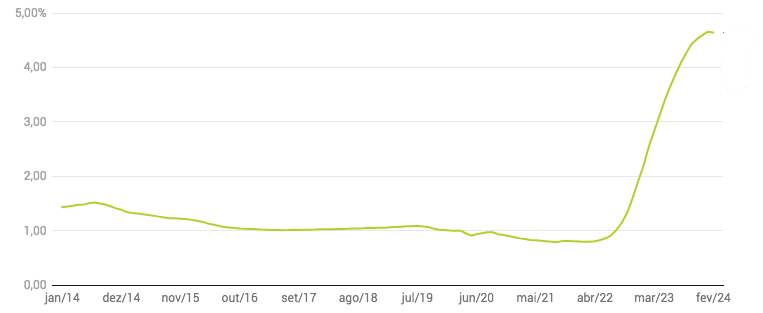

House payments also decreased in February 2024. In new contracts, interest rates decreased for the 4th time. Interest on new housing loans has been falling for four consecutive months, having stood at 4.197% in February. Now, it is observed that the recent (slight) drops in Euribor and the more accessible mixed rates are also having an effect on the interest rates implicit in the total number of...

Central banks have significantly raised interest rates over the past two years to combat post-pandemic inflation. But why are some countries feeling the impact of higher rates and others not? The answer lies, in part, in the differences in the characteristics of the mortgage and real estate markets, according to the International Monetary Fund (IMF). And therefore, he argues, "continuing to tighten or...